Rivian (RIVN) hit its purpose of attaining a constructive gross revenue within the fourth quarter. The EV maker launched its fourth-quarter earnings after the market closed on Thursday. Right here’s a full breakdown of Rivian’s This autumn 2024 financials.

Rivian achieves first gross revenue in This autumn 2024 earnings

Yesterday, in our This autumn earnings preview, we famous that the largest factor buyers can be searching for is that if Rivian will obtain a constructive gross revenue because it has guided all yr.

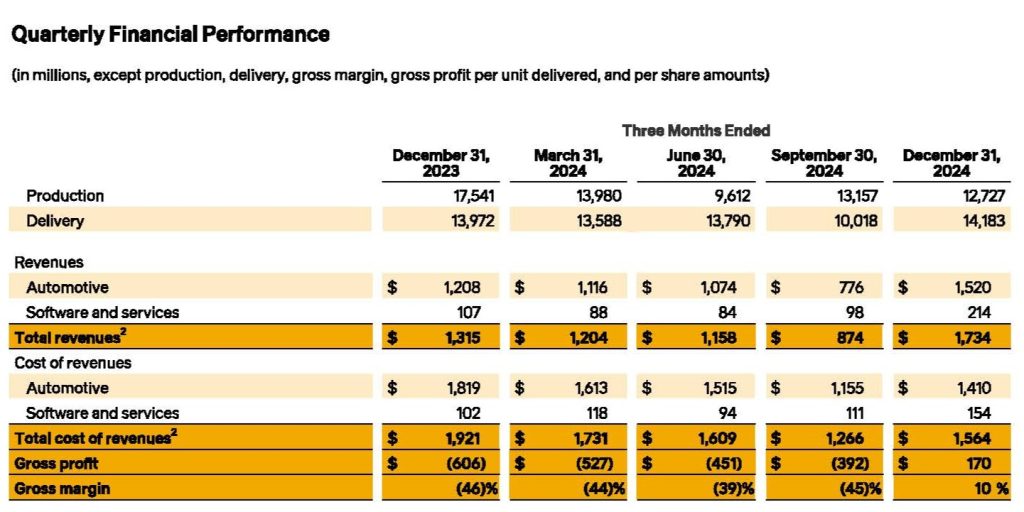

Rivian hit its purpose, posting a gross revenue of $170 million within the fourth quarter, a $776 million enchancment from This autumn 2023. Of which, $100 million was from auto gross sales, and the opposite $60 million was from software program and companies.

Decrease prices, together with per automobile delivered, drove the achievement. Along with plant upgrades, Rivian noticed a noticeable value enchancment after launching its second-generation R1 fashions.

Rivian posted whole fourth-quarter income of $1.73 billion, simply topping Wall St expectations of $1.4 billion. Whole automotive income was $1.52 billion, primarily from the 14,183 automobiles Rivian bought within the quarter. Rivian additionally generated $299 million from the sale of regulatory credit and $484 million from software program and companies.

- Rivian This autumn 2024 Income: $1.73 billion vs $1.4 billion anticipated

- Rivian This autumn EPS loss: 0.70 loss per share vs 0.68 loss per share anticipated

CEO RJ Scaringe stated, “This quarter, we achieved constructive gross revenue and eliminated $31,000 in automotive value of products bought per automobile delivered in This autumn 2024 relative to This autumn 2023.”

Rivian generated $110 million in automotive gross revenue within the quarter in comparison with a lack of $611 million in This autumn 2023. For the complete yr, Rivian generated a destructive automotive gross revenue of $7 million, an enchancment from the $12 million loss in 2023.

The EV maker produced 49,476 automobiles at its Regular, IL plant final yr and delivered 51,579. That features the R1S SUV, R1T pickup, and electrical supply van (EDV) for Amazon. Earlier this month, Rivian additionally opened orders for its Business Van for patrons outdoors Amazon.

Rivian posted a internet lack of $743 million within the fourth quarter, down from an over $1.5 billion loss in This autumn 2023. For the complete yr, Rivian posted a internet lack of $4.75 billion, down from $5.43 billion in 2023.

The subsequent development stage

Through the fourth quarter, Rivian additionally closed its EV three way partnership with Volkswagen. The deal is value as much as $5.8 billion, of which Rivian says $3.5 billion is predicted to be obtained over the subsequent few years. Rivian will provide its EV structure and software program for Volkswagen’s next-gen fashions.

The primary can be Rivian’s midsize R2, a smaller, extra inexpensive electrical SUV. It would begin at round $45,000, or practically half the present R1S ($77,700) and R1T ($71,700).

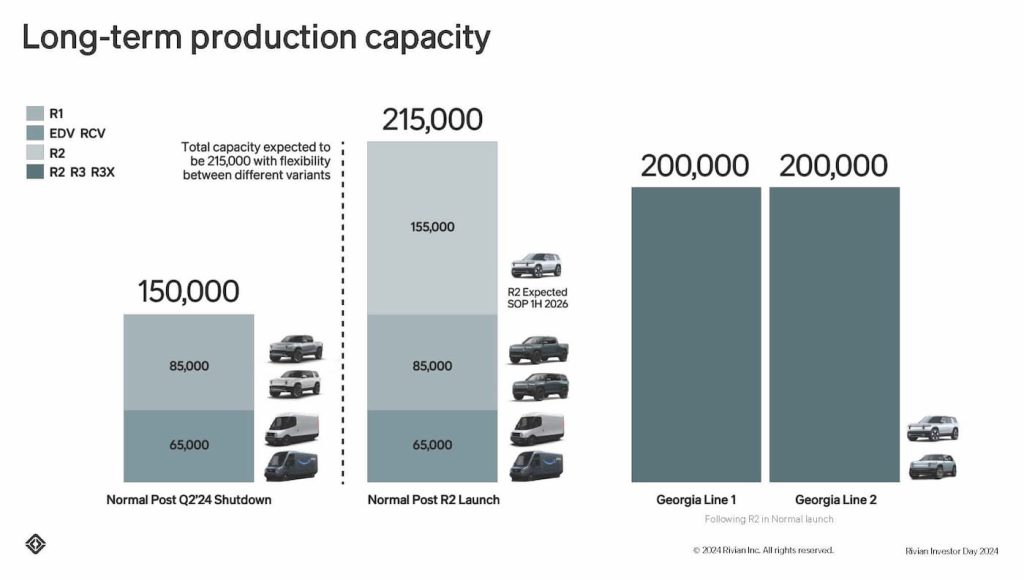

Rivian plans to start R2 manufacturing in Regular early subsequent yr, but it surely expects to considerably scale up with its new manufacturing plant in Georgia.

Though it closed its mortgage settlement with the US DOE for as much as $6.6 billion proper earlier than Trump took workplace, Georgia Gov Brian Kemp stated this week he’s uncertain the place the funding stands.

Rivian remains to be assured the funds can be out there after they draw on them subsequent yr. The plans embody constructing the plant in two phases, every including 200,000 models of capability. Rivian stated the R2 and even smaller R3 are “important drivers within the firm’s long-term development and profitability.”

The corporate stated on Thursday that the DOE mortgage and capital from the VW partnership, along with its present money and equivalents, “is predicted to offer the capital assets to fund operations via the ramp of R2 in Regular, in addition to the midsize platform in Georgia—enabling a path to constructive free money stream and significant scale.”

Rivian stays targeted on chopping prices, enhancing effectivity, and launching its mass-market R2 electrical SUV.

Scaringe stated, “I couldn’t be extra enthusiastic about R2, and I consider the mixture of capabilities and price efficiencies, together with the superb degree of pleasure from clients, will make R2 a very transformational product for Rivian.”

| Q1 2024 | Q2 2024 | Q3 2024 | This autumn 2024 | Full-12 months 2024 | 2025 steerage | |

| Deliveries | 13,588 | 13,790 | 10,018 | 14,183 | 51,579 | 46,000 – 51,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | N/A |

Regardless of this, Rivian expects decrease deliveries of between 46,000 and 51,000 in 2025 because of exterior components, together with modifications in authorities insurance policies and rules. After delivering extra EDVs to Amazon in This autumn, Rivian expects decrease quantity in 2025

The corporate expects an adjusted EBITDA loss between $1.7 billion and $1.9 billion, with Capital Expenditures of $1.6 billion to $1.7 billion.

Rivian ended the quarter with $7.7 billion in money and equivalents. Together with different capital, the corporate ended the yr with barely over $9 billion in liquidity.

Examine again for extra updates from Rivian’s fourth-quarter earnings name. We’ll put up updates under.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.